01/11/2024 – 13:46

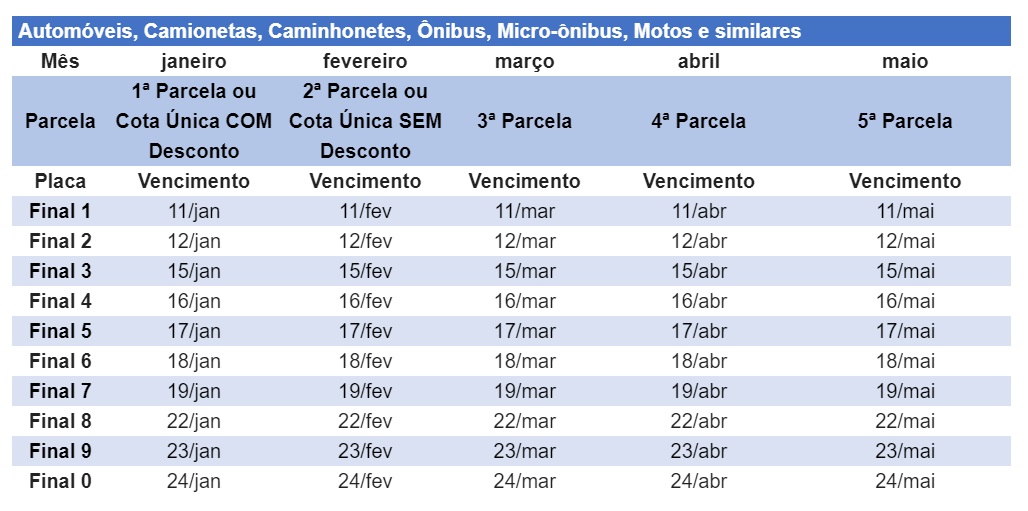

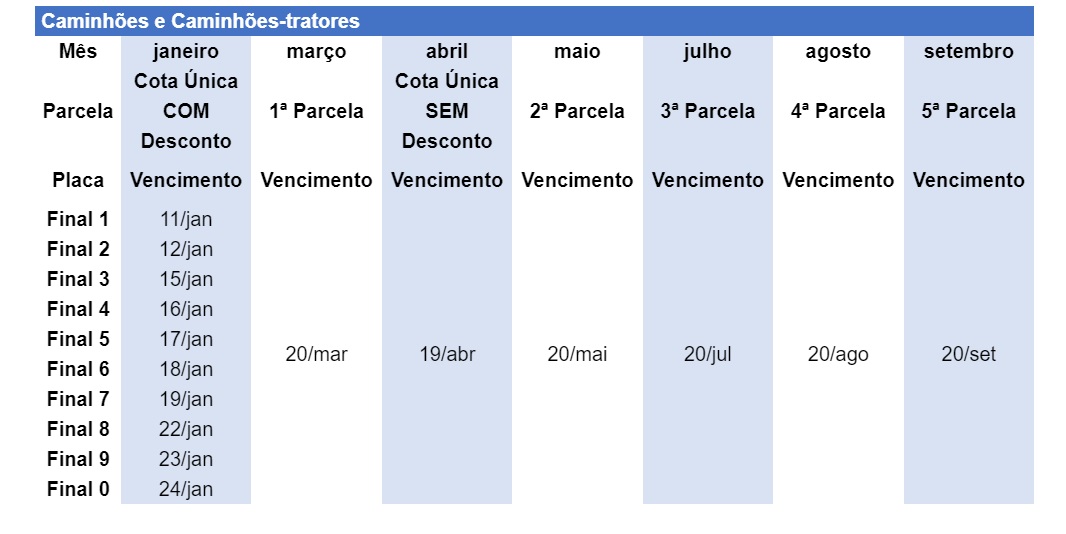

The due date for the IPVA 2024 for the state of São Paulo it starts this Thursday, 11th, for vehicles with end plate 1. It is worth noting that the first dates are for cash payment with a 3% discount.

The value can be consulted by the owner in the banking network or on the Sefaz-SP portal (Secretariat of Finance and Planning of the State of São Paulo) in this link. Just enter your Renavam number and vehicle license plate.

+ How to pay the 2024 IPVA and IPTU with discounts? See complete guide and calendars

Check out the calendars below:

Payment

To pay the tax, the taxpayer can use the accredited banking network, with the Renavam number (National Motor Vehicle Registry).

The tax can be paid via the internet or scheduled debit, at self-service terminals or other channels offered by the banking institution. Another possibility is lottery outlets, credit cards and Pix, in companies accredited by Sefaz-SP.

Pix

See below how to pay via Pix:

- To use Pix, the citizen must access the IPVA page on the Sefaz-SP portalenter the vehicle details and generate a QR code, which will be used for payment;

- The Pix QR code is valid for 15 minutes, after which it expires;

- If it has not been paid, it will be necessary to issue a new QR code;

- On the QR code screen, there is a “remaining time” counter indicating when the code will expire;

- When reading the QR code with the bank or payment institution application, information will appear that the payment is destined to the “Secretariat of Finance and Planning”, under CNPJ 46.377.222/0003-90 in a Banco do Brasil account.

Values

The market value table serves as a parameter for calculating IPVA 2024. To get an idea of the amount to be paid, simply multiply the market value (Fipe Table) by the state's tax rate.

The IPVA rates are 4% for passenger cars, 2% for motorcycles and similar vehicles, single-cab trucks, minibuses, buses and heavy machinery; 1.5% for trucks and 1% for rental vehicles.

Delay in payment

Anyone who delays payment is subject to a fine of 0.33% per day and late payment interest based on the Selic rate. After 60 days, the fine percentage is set at 20% of the tax amount.

#IPVA #maturity #calendar #discount #starts #Thursday