Last The stock market listing market, which was record high in 2006, has almost completely frozen during the first part of the year, as uncertainty in the stock market has increased with the war and rising interest rates.

The listings planned for the spring have so far been largely frozen to await the stabilization of the market situation.

“No listing has been completely canceled, we have only stretched the schedules,” says Nordea’s Senior Vice President, Large Customers. Petteri Änkilä.

The same message is shared by other listing organizers.

“We aim to complete the listings next fall,” says the director Jaakko Eteläaho From Danske Bank.

The eyes of others have already shifted to next fall.

“

Even those listed on the stock exchange have not done very well, even though two of them oversubscribed.

For now Only three new companies have been listed on the Helsinki Stock Exchange this year. At the turn of the year, there were many more expectations, at least a dozen during the first half of the year, says Nasdaq Helsinki CEO Henrik Husman.

“It’s still possible that we’ll get four new listers before the end of June,” Husman estimates.

He is expecting another 5-10 new listers by the end of the year. He says it’s hard to believe that listings would coagulate for a long time with the model of years ago.

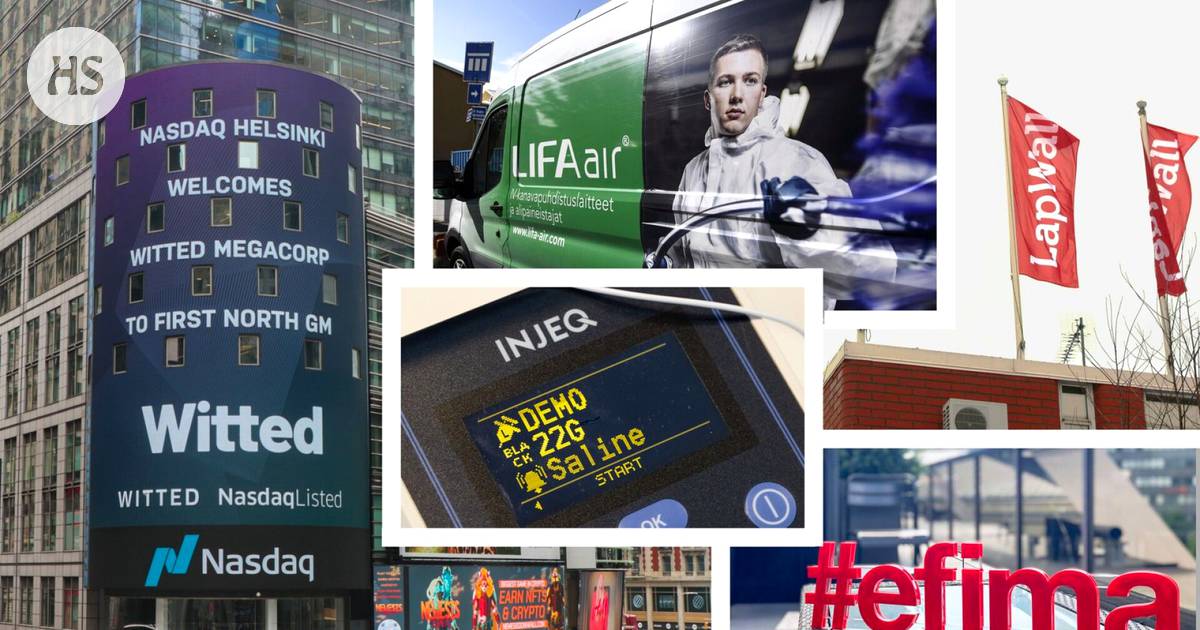

In addition to the three stock market entrants seen so far, two IPOs have hit the counter in the middle of it all. The cloud service company Efima canceled its listing at the beginning of February, citing the poor market situation. Smart needle company Injeq, meanwhile, switched from IPO to crowdfunding in March.

Even those listed on the stock exchange have not done very well, even though two of them oversubscribed.

Lapwall, a manufacturer of wood elements, was oversubscribed in April, as did Witted Megacorp, a software company that started the stock exchange last Friday. Still, Witted Megacorp’s share immediately fell below the subscription price at the start of the stock exchange and Lapwall’s share returned to the listing price after the initial rise.

Even worse has happened to Lifa Air, known for its respirators, whose issue fell short and the stock collapsed at the stock market launch in April.

All three were listed on First North.

Like Helsinki, the IPO market has froze on other stock exchanges since Wall Street. There have been 25 IPOs listed in Stockholm at the beginning of the year, when there were largely another hundred during the whole of last year.

Last year, the listing record for the techno bubble at the end of the last century was broken in Helsinki, and 29 new entrants entered the stock exchange, a dozen during the first half of the year.

Part IPOs have only been suspended for a few weeks since the rumble in the stock market accelerated. For many, however, the war started by Russia was the one that broke the brake during March.

“Once Russia’s offensive war had begun, it was immediately clear that it was going to reduce investor interest in listings, and that nervousness in the market would continue for some time,” Eteläaho says.

According to him, it is not worthwhile to penetrate the market.

Danske had a few listings under construction at the beginning of the year.

“However, no IPOs have been put in the deep ice as was done during the financial crisis. Now the promotion of projects will be continued so that we are ready to proceed with the listing as soon as the market situation becomes clearer, ”Eteläaho says.

Others say they do the same.

Nordea was working on the listing of as many as five large companies during the spring. All five were to be listed directly on the stock exchange’s main list. Now everyone’s schedules have been postponed.

According to Nordea’s Änkilä, investors are now so cautious that it would not make sense to try to list in the current market situation.

“When large institutional investors sell shares, they do not consider buying new shares,” Änkilä points out.

According to Änkilä, pricing of listings would also be very difficult when the stock market fluctuations are strong. It is difficult for a company to get the best possible valuation in a market situation like the current one.

“

“Some foreign investors have also considered Finland’s country risk higher due to the war in Ukraine, and are therefore not interested in Finnish IPOs.”

The EC, which consults companies on IPOs, has had a dozen IPOs in progress, most of which have been postponed, but not all.

“A couple of companies still plan to go public before the end of June, but it remains to be seen what conclusions will be drawn if the stock market recession continues,” said the EC’s Director of IPO Services. Päivi Pakarinen.

As the spring progressed, pre-market marketing of IPOs to large investors made it clear that investors were reluctant to commit to IPOs.

“Some foreign investors have also considered Finland’s country risk higher due to the war in Ukraine, and are therefore not interested in Finnish IPOs. Let’s see how Finland’s future NATO membership can affect this, ”says Pakarinen.

According to Pakarinen, some of the stock exchange candidates themselves have suffered from the situation caused by the war in Ukraine, for example due to supply chain problems and the severance of dependence on Russia. This may also have meant a weaker-than-expected result in the first half of the year, which has taken away the desire to list.

So If listings recover, stock market nervousness should be eased. Everyone interviewed agrees.

“The current market situation is poison to listings, but when it calms down, good companies have a good chance of getting money back on the stock exchange,” Eteläaho says.

According to him, the positive thing is that now investors have not panicked as in previous crises, but rather just jumped into the auditorium to wait.

But what if the stock market downturn continues for a long time, even in the fall? Can listing succeed at all as rates fall?

According to Änkilä, it may be possible for a very stable company with good anchor investors to secure a listing.

“Otherwise, it is more sensible to wait for the situation to calm down unless you have to go to the stock exchange to get capital right now,” says Änkilä.

It is also a question of whether the old owners are ready to list their company on the stock exchange at a lower price than previously planned.

Pakarinen also reminds us of the right pricing. A company needs to be really good if listing in an uncertain market could succeed.

“

“In last year’s hot IPO market, there were also lower quality companies that should not have been listed on the stock exchange.”

All right it is already that the IPO market will not return to normal.

In the future, investors’ requirements for listed companies will be stricter than before. The quality of companies is becoming more important than before.

“In last year’s hot IPO market, less high-quality companies ended up on the stock exchange that should not have been taken there,” says Änkilä.

Southaho agrees. They do not want to mention the names of the companies.

Last year’s IPO success has been very mixed since listing. For example, Kempower’s share, which manufactures fast charging devices for electric cars, has risen in price from a subscription price of EUR 5.74 to more than EUR 12 since the listing. The share of the health technology company Nightingale Health, on the other hand, has plunged from a subscription price of EUR 6.75 to approximately EUR 1.8.

According to Änkilä, the requirements will increase in terms of company size, profitability and turnover.

According to Eteläaho, rising interest rates will also change what investors pay attention to in companies.

In the future, cash flow and return through dividends will be even more important criteria when investors consider participating in listings. This means that companies whose positive cash flow is still far in the future will no longer be of interest to investors in the former model.

“Until just over a year ago, such growth companies were just the most sought-after stock market candidates. Now the situation is the opposite, ”says Eteläaho.

According to Eteläaho, this may lead to some companies intending to go public for the time being.

The share prices of growth companies have been pounding around the world since the end of last year.

Stock exchanges The end of the long rise may also lead to a decline in the interest of private equity investors in exiting companies through a stock exchange listing.

“In the future, selling a company may in some situations bring a better price than listing it on the stock exchange,” says Änkilä.

Over the past couple of years, the stock market has gotten the best price for the company, and that’s why listing has been the preferred way for venture capitalists to exit their holdings. The most common way has still been to sell the company.

So far, there is no change in this, says the CEO of the Private Equity Association Pia Santavirta.

“Exits may have taken extra time to make suitable solutions. All options are definitely still on the table, ”says Santavirta.

He believes the attractiveness of the stock market will remain.

Last year, the stock exchange saw an exceptional number of companies listed by private equity investors, with more than 10 percent of exits being listings. Venture capitalists listed a total of 18 companies, five on the main list and 13 on First North.

#Stock #Exchange #record #number #companies #entered #Helsinki #Stock #Exchange #year #Listing #postponed #fears #investing #Finnish #companies