The ECB and financial mathematics

There financial mathematics It is a branch of mathematics applied science that deals with the study of problems related to finance and economic investments. In other words, it focuses on financial operations involving monetary capital or capital that can be valued in monetary terms. Now, theat the European Central Bank it falls within the parameters of financial mathematics, but to tell the truth I have some doubts about its application. As a modest analyst I have crossed some numbers and I have obtained a data series that leave me perplexed and dissatisfied. To begin, here is a first chart of annual inflation from 2014 to recent May 2024question is it clear that inflation has dropped?

Eurostat has always “weighed” the various components of inflation, what can be deduced?

This This passage only concerns Italy and should give a sense of what the incidence of inflation has been in the last 2 years or so.

Now, the President Lagarde insists that she is data-dependent, she basically follows the numbers, but the question is which data and which numbers? This, at the moment, is not known or perhaps they do not even know it at the ECB; because if this were the case, is it legitimate to think that we are relying on sailing by sight? What do I want to say? Try to think with what courage, we Europeans must face these words: ECB, Lagarde: “We could stop at just one rate cut, too many unknowns” (retrieve here the article from Affaritaliani.it) and as we all know the unknown, that is x, is an independent variable. The article started with the meaning of financial mathematics and so here is a “fact”: we went from a rate of 0.50% to a rate of 4.5%, do you know how much the increase is? 800%! Yes, eight hundred percent!

And all this to bring inflation back to the 2% range, which I won’t bore saying and writing, which has nothing scientific about it! In fact, they have coined a new term for inflation: the 2% symmetric. Not having understood the meaning, here is the answer: “Symmetry is a particular geometric transformation that keeps the measurable characteristics and shape of an object unchanged. In other words, when an object is symmetric, we can perfectly superimpose it on a reflected or rotated copy”. Symmetry: definition and types of symmetries | Matemania.it Who is responsible for inflation? From time to time, the blame is placed on the increase in gas and hydrocarbons in general, which have gone from the first from €300 per MWh to the current €35 and oil from $114 to the current $80, in addition to various geopolitical factors.

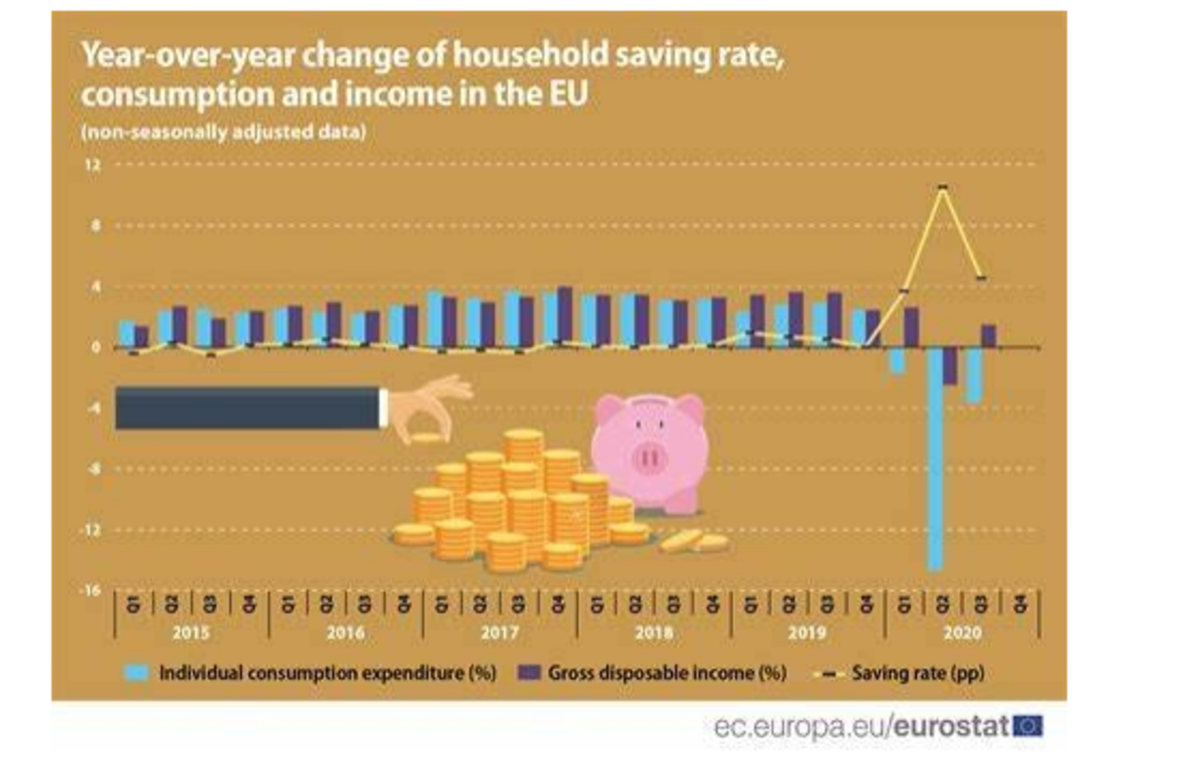

What does all this mean? A drastic decrease in consumption? Not at all! Despite everything, consumption is recovering as are jobs with an incredible reduction in unemployment, never so low since the euro existed. Despite this, President Lagarde, the board and the governors present in the ECB “do not want” to hear talk of reducing interest rates, they postpone everything to the phantom 2%, not even if they were to conquer Everest. “The Protocol on the Statute of the European System of Central Banks and of the ECB also specifies that: “Neither the ECB, nor a national central bank, nor any member of their decision-making bodies shall seek or take instructions from Community institutions or bodies, from any government of a Member State or from any other body. The Community institutions and bodies and the governments of the Member States undertake to respect this principle and not to seek to influence the members of the decision-making bodies of the ECB or of the national central banks in the performance of their tasks”. Ergo, no one can say anything about it. So let’s go back to mathematics and graphics. This slide from Eurostat says it all:

A few days ago, one of our Ministers also lashed out against the ECB’s monetary policy. Just for a change? To conclude It is not possible to challenge the decisions taken by the ECB, we can fear what could happen in the near future. Dafter having “massacred” the BTP prices with losses of up to 40% compared to the historical highs, which have affected the portfolios of banks, savers or money market funds which have lost up to 5% of the value of their shares. To close we have seen real estate funds struggling in prices and management and with some failures in between, the markets have supported both the attitudes of the Federal Reserve and those of the ECB, so the question arises spontaneously until when the financial market will be able to hold up? Everything is based only on one word: TRUST and the latter does not care highly about any justifications, however we hope it does not fail.

|

What is symmetry?

There symmetry is a particular geometric transformation that keeps the measurable characteristics and shape of an object unchanged. In other words, when an object is symmetric, we can perfectly superimpose it on a reflected or rotated copy. There are different types of symmetries:

1. Axial symmetry:

This type of symmetry is based on a segment or line called the “axis of symmetry”. Every point of the figure is symmetrical with respect to the axis of symmetry with respect to another point of the same figure.

2. Central symmetry:

It is defined starting from a point called the “center of symmetry”. Each point of the plane is associated with a point symmetrical with respect to the center, maintaining the center point as the midpoint of the segment between the two points.

3. Radial symmetry

For example, all regular polygons have radial symmetry with respect to the center of the inscribed or circumscribed circle12: A figure is symmetric with respect to radial symmetry if, by rotating it around a point, we obtain a figure that perfectly overlaps the starting one.

|

#ECB #rate #cuts #heres #hawk #Lagardes #numbers #dont #add