The car market in Europe it started 2024 on the rise. According to data fromEuropean Manufacturers Association (Acea)in January registrations in the area including the European Union, the EFTA countries and the United Kingdom reached 1,015,381 unitsregistering a 11.5% increase compared to the same period of the previous year, i.e. 2023.

Cars sold in Europe January 2024

In January, registrations still remained far from pre-crisis levels (-17.2% compared to January 2019), but reached 1,015,381 with growth of 11.5% compared to January 2023. Almost all the countries in the area mentioned above recorded demand supported mainly by purchases of company fleetsfrom the long-term rental company and by the purchases of electric cars facilitated by generous incentives.

Pure electric car (BEV) registrations were 120,926 with an increase of 29.3% on January 2023 and a market share of 11.9%, lower than the 15.7% recorded in the whole of 2023.

Car sales Italy, Germany, France, United Kingdom and Spain

The growth did not involve all 31 countries in the area, but was concentrated in the main five markets which absorbed approximately 70% of registrations. There Germany recorded the largest increase with a +19.1%even if compared with a particularly difficult January 2023 due to the negative dynamics linked to incentives for electric cars. The other four main markets recorded less significant, but still noteworthy, increases: +9.2% in France, +8.2% in the United Kingdom, +7.3% in Spain And +10.6% in Italy. The differences in shares of electric cars among the main countries are notable: 10.5% in Germany, 16.4% in France, 14.7% in the United Kingdom, 4.9% in Spain and 2.1% in Italycompared to 4.2% recorded in all of 2023.

Food sales

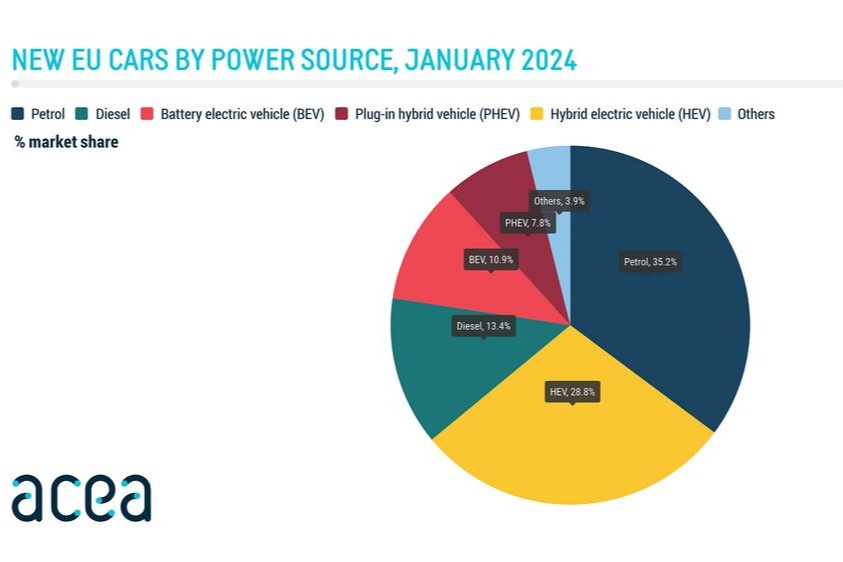

As of January 2024, battery electric car sales increased by 28.9%, reaching 92,741 unitswith an overall market share of 10.9%. The four main markets in the region, which together cover 66% of all battery electric car registrations, recorded robust double-digit increases: Belgium (+75.5%), the Netherlands (+72.2%), France (+36.8%) and Germany (+23.9%).

Also new registrations of electric hybrid cars in the EU they increased by 23.5%, driven by significant growth in the four largest markets: Spain (+26.5%), France (+29.9%), Germany (+24.3%) and Italy (+14.2%). This led to the sale of 245,068 units in the first month of 2024, equal to 28.8% of the share EU market.

Sales of plug-in hybrid cars recovered after a decline in December 2023, increasing by 23.8% to 66,660 units in January 2024. This increase was primarily driven by significant increases in key markets such as Belgium (+65.2%) And Germany (+62.6%). As a result, plug-in hybrids are now the 7.8% of sales car totals in the EU.

As regards traditional engines, in January the market for petrol cars grew 4%, driven by significant increases in key markets such as Italy (+26.7%) and Germany (+16.9%). Despite maintaining its lead with 35.2% of the market in January, the share of petrol cars has decreased compared to 37.9% in the same month of 2023.

On the contrary, the market for diesel car of the EU decreased by 4.9% in January. This decline was evident in several markets, including three of the largest: France (-23.4%), Spain (-10.2%) and Italy (-8.7%). But the Germany deviated from this trend at a rate of growth of 4.3%. In January 2024, sales of diesel cars have reached therefore 114,415 units, representing a market share of 13.4%, down from 15.8% in 2023.

Who sold the most in Europe

Among the main automotive groups, the Volkswagen group went very well with 258,402 registrations8.1% more than in January 2023. Although the eponymous brand dropped by 5.2%, this was offset by growth in Skoda (+15.2%)Audi (+10%), Seat (+24.1%), Cupra (+79.4%) and Porsche (+0.95%).

Also Stellantis went well with 183,120 registrations, with an increase of 16.9%. Almost all of its brands recorded positive performances: +22.8% for Peugeot, +35.3% for Opel/Vauxhall, +20.3% for Citroën, +22% for Jeep, +13.7% for Alfa Romeo , +9.2% for Lancia. In reverse, Fiat (-7.5%)DS (-6%) and Maserati (-43.5%) remained behind.

The BMW group recorded growth of 29.7%, with 72,259 cars registered, thanks to the 33.9% increase in the BMW brand and the 11.4% increase in the Mini. Mercedes-Benz instead it marked a decline of 10.6%, with 424,258 registrationsmainly due to the decline of the main brand (-10.1%) and Smart (-23.7%).

The Renault group suffered a decrease of 2.1%, with 92,935 registrations, while Ford saw a 6.1% contraction, with 35,603 registrations. In contrast, Volvo (+25.2%), Tesla (+86.3%) and Jaguar Land Rover (+25.3%) recorded significant growth.

Hyundai/Kia confirmed itself in first place among Eastern manufacturers with an increase of 1.2%, while Toyota gained 9.2%, with growth of 8% for the Toyota brand and 32% for Lexus. Other significant increases were recorded by Nissan (+38%), Honda (+27.2%), Suzuki (+25.4%), Mitsubishi (+96.8%) and Saic Motor (+26.9%)the latter entering Acea's surveys for the first time.

Read also:

→ Survey which car would you buy today?

→ Read other related topics

→ What do you think? Drop by discussions on the FORUM!

#Car #sales #Europe #data #January