Elections in France, the challenge of public debt

The first round of French parliamentary elections, called early by President Emmanuel Macron after his coalition’s defeat in the European elections in June, concluded on Sunday. The first round saw the victory of Marine Le Pen’s Rassemblent Nationalthe leading party with 33.1% of the votes, followed by the Gauche at 27.9% and Macron’s presidential camp at 20%. The second round of elections is scheduled for next Sunday and will decide whether the Rassemblement National will be destined to govern with an absolute majority.

According to the polls, Support for the most extreme parties on both the left and the right has raised concerns among investors and pushed up the cost of French government debt. Politicians from the Rassemblement National have sought to reassure investors about their spending plans and their possible relationship with the European Union, but it seems that some of their proposals, such as reducing the retirement age from 62 to 60, will not be well received. The fear is that the new government could dust off France’s fiscal challenges.

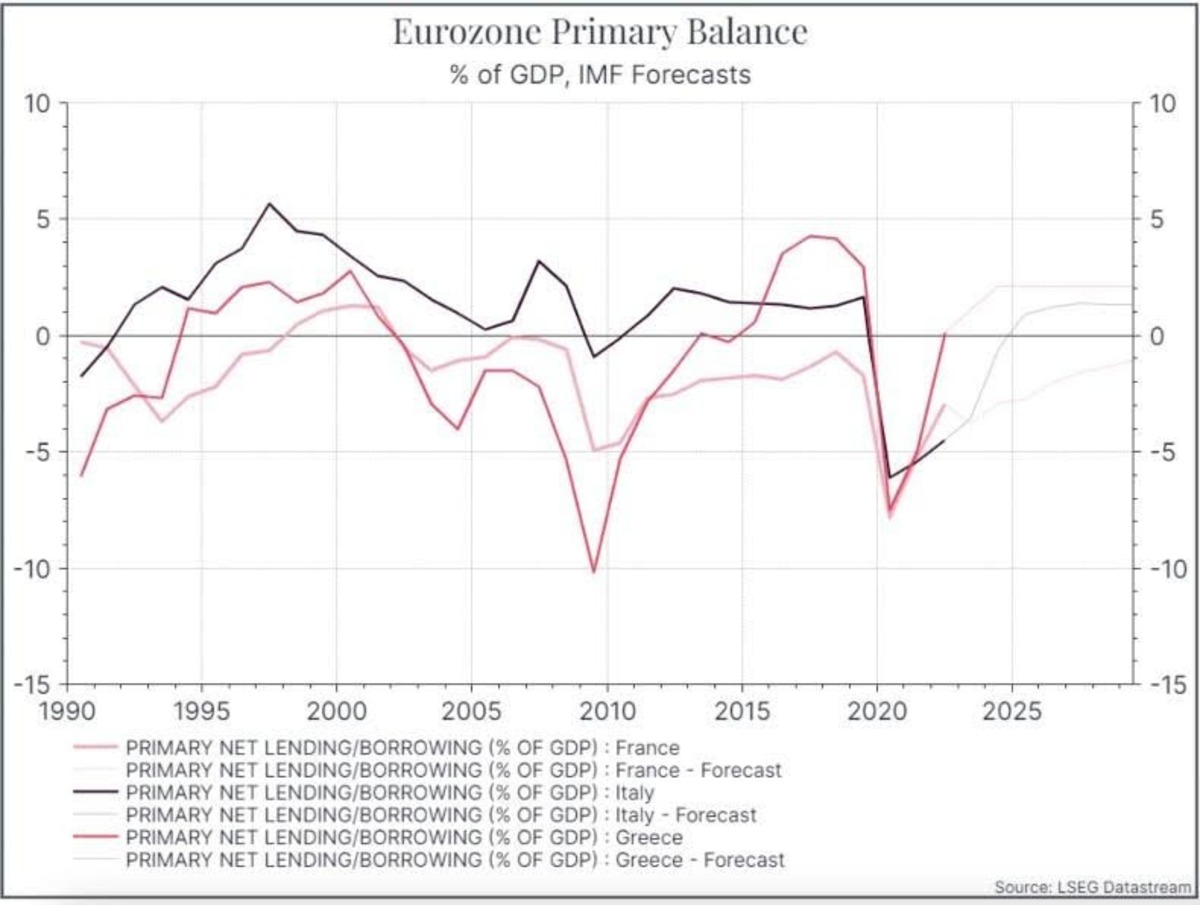

If we compare the debt/GDP ratio of Italy, Greece and France, the latter is certainly ahead today, but if we observe the evolution of the parameter over time, the picture changes: Over the last twenty-five years, the debt/GDP ratio in Italy has remained fairly stable, while in France it has increased more significantly and, according to estimates by the International Monetary Fund, is set to rise furtherwhere Greek debt/GDP, for example, is expected to decline quite sharply.

Looking at the primary balances, it is noticeable The increase in French public spending following the Covid emergency: for the near futurethe IMF expects both Greece and Italy to post primary surpluses, while France is expected to remain in deficit.

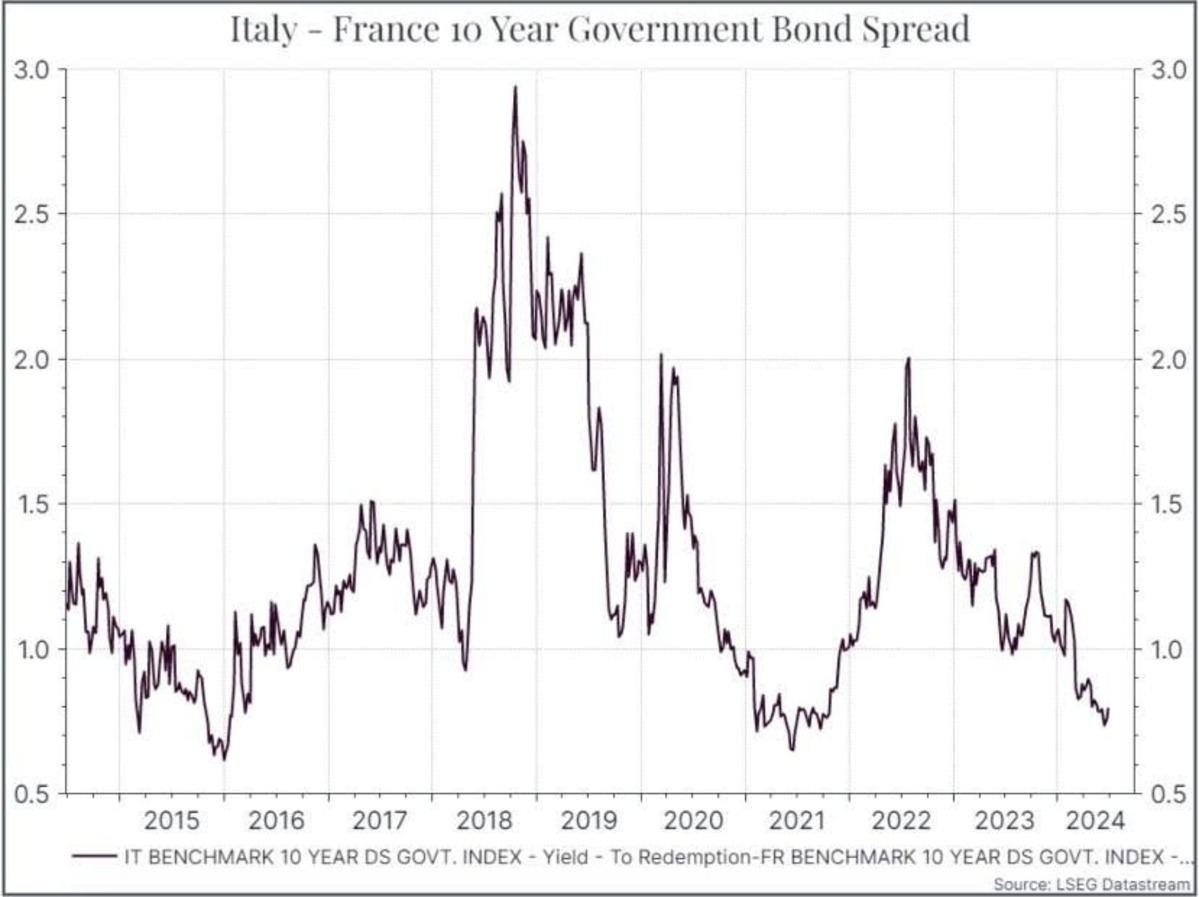

Turning to the cost of government debt, attention has recently focused on the widening gap between French and German ten-year government bond yields, but the reduction in the spread between France and Italy should not be overlooked, a prospect that is not so unusual in light of their respective fiscal positions.

We are convinced that in the short term French elections to be positive for investorsbut this does not mean that the spread between French and German debt will narrow. The spotlight therefore remains on France’s fiscal prospects.

*Chief Investment Officer of Moneyfarm

#France #investors #fear