Otkritie clients will have an extended grace period on their credit card when switching to VTB

Otkritie is merging with VTB — by the end of the year, they should become one bank. Otkritie clients are offered to switch to VTB services. Usually, the decision to change banks is caused by the desire to get some advantages. Improving the quality of service and favorable personal offers are a good reason. VTB is counting on this. About the advantages of switching in the material of Lenta.ru.

Flexible conditions

Changing banks always raises questions. You have to change your established habits: get used to the location and layout of offices, the website, and the mobile app all over again. In this regard, the transition of retail clients from Otkritie to VTB is organized as conveniently as possible.

VTB has developed a special service for online transition. It is available both through a mobile application and through Internet banking. Any actions can be performed remotely, there is no need to go to the bank office. Although, if you are more accustomed to live communication, you can arrange the transition at any Otkritie office. Everyone chooses which option is preferable.

With the help of the online transition, Otkritie clients can transfer their cards, accounts, deposits, loans in a few clicks

There are no strict limits for re-registration, you can choose any option from the VTB line taking into account your personal needs. Moreover, the conditions may become more favorable, especially in terms of cashback, which VTB now accrues in rubles – up to 25 percent of the purchase amount in selected categories.

Debit cards do not need to be reissued to switch to VTB. Only the account they are linked to will change. After reissuance, card transactions will be processed using VTB details. At the same time, the validity period for all reissued cards is extended until 2029.

Deposits and loans of Otkritie clients are being transferred to VTB under the same conditions. Co-branded cards will also continue to be valid until their expiration date. To make it profitable for Otkritie clients to switch to VTB, they have access to up to five additional offers from VTB, including cashback of up to 25 percent on debit cards, increased rates on deposits and savings accounts, a new grace period of up to 200 days on the amount of debt, and cashback of up to 10,000 rubles on the amount of transferred debt for credit card holders.

Otkritie clients with active premium status receive the Privilege service package with a year of free service

Re-registration of a credit card will increase not only the benefit from cashback, but also the grace period – it will be 200 days. Without accrual of interest for using credit funds, you can make purchases, withdraw cash, make transfers. And the debt on the credit card when switching to VTB can be refinanced.

Bank for the whole family

VTB builds relationships with clients within the framework of the “Family Bank” concept. Its purpose is to offer a family a comprehensive solution for everyday financial issues, taking into account the interests of each of its members. The bank does not charge a commission for paying for housing and communal services, kindergartens and schools, and also provides a number of social services.

For example, using the “Social Calculator” you can calculate the federal payments due to your family. Also, the bank’s clients can apply for a property tax deduction and use maternity capital to pay off a mortgage online. In addition, VTB insures all children of recipients of social payments for free in case of critical illness.

For pension recipients, special allowances apply to the VTB savings account and VTB deposit

The bank accrues them seven percent per annum on the balance of the current account up to 100 thousand rubles every month, does not charge a commission for cash withdrawals from third-party ATMs throughout the country. VTB also insures pension recipients at its own expense against fraudulent transactions with an account and card, the insured amount is 100 thousand rubles. Every month they can choose the cashback category “pharmacies”.

All bank clients can apply for additional cards and stickers for their loved ones. This helps to manage the family budget more conveniently and to instill financial literacy skills in children.

More opportunities

The transition to VTB expands the choice of products and services for Otkritie clients.

During the online transition, they have access to up to five additional offers. For example, clients can use a savings account with a rate of up to 20 percent per annum. VTB also offers cashback of up to 25 percent in rubles in selected categories for both debit and credit “Card of Opportunities” with free service.

Recipients of pensions and social benefits are entitled to additional payments for transferring deposits to VTB

In the future, they can use all the advantages of VTB’s financial products and services. For example, VTB offers all types of programs with state support. Consumer lending is also among its strengths: today, VTB issues every fifth retail loan in Russia.

The rapidly accelerating world places high demands on the availability of banking services. By switching to VTB, Otkritie clients will benefit from a better level of service. They will have access to more ATMs, more offices, and more services.

VTB is the second bank in the country. The bank has been working for individuals for almost 20 years, which means it has enormous experience working with the population

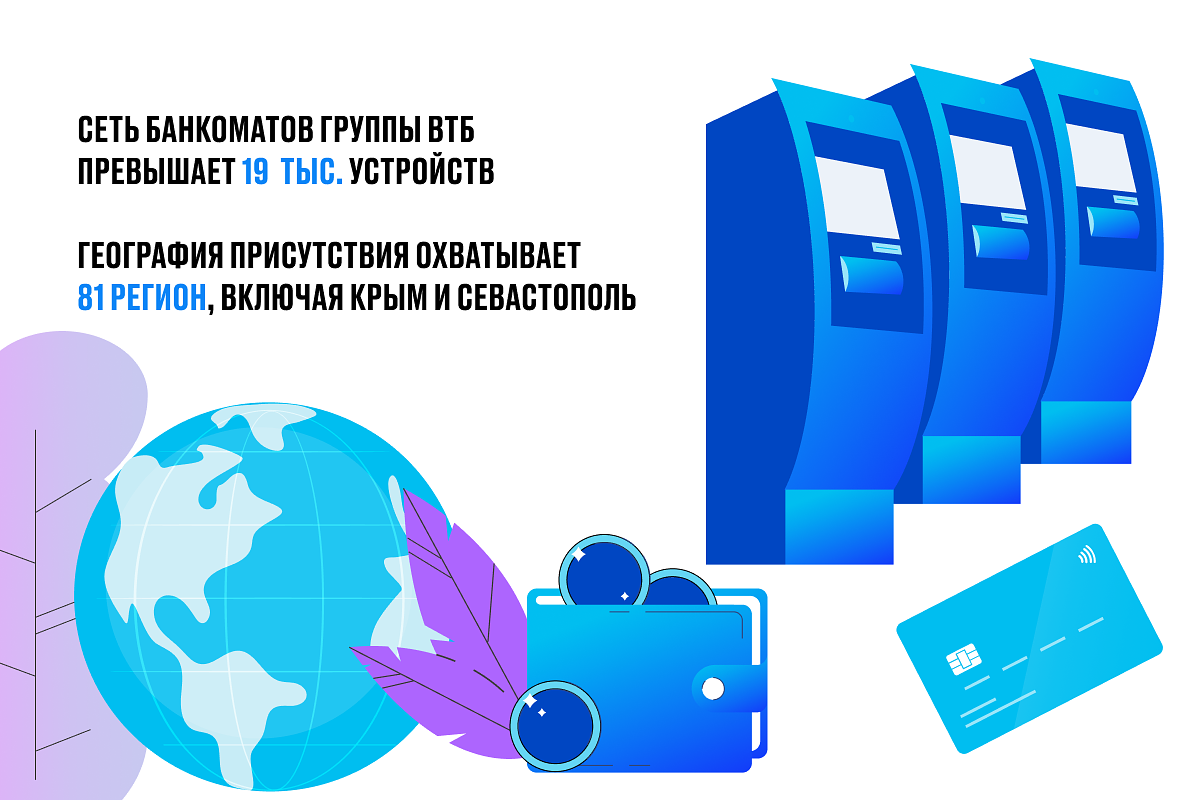

Today, VTB potentially covers more than 50 million people who use banking services. VTB’s office network — about 1.3 thousand points — is one of the largest in the country and is represented in almost all regions. By 2026, VTB will significantly expand its presence and cover cities with a population of 50 thousand people.

By 2026, the total number of bank offices will increase by

40 percent and reach 1.8 thousand. The combined ATM network (VTB, RNKB and Otkritie) includes over 19 thousand devices, and thanks to the RNKB ATM network, it covers Crimea and Sevastopol.

No matter what channels of interaction with VTB a client chooses, he will always feel comfortable and benefit from using high-tech, yet affordable products.

#Otkritie #merging #VTB #give #clients