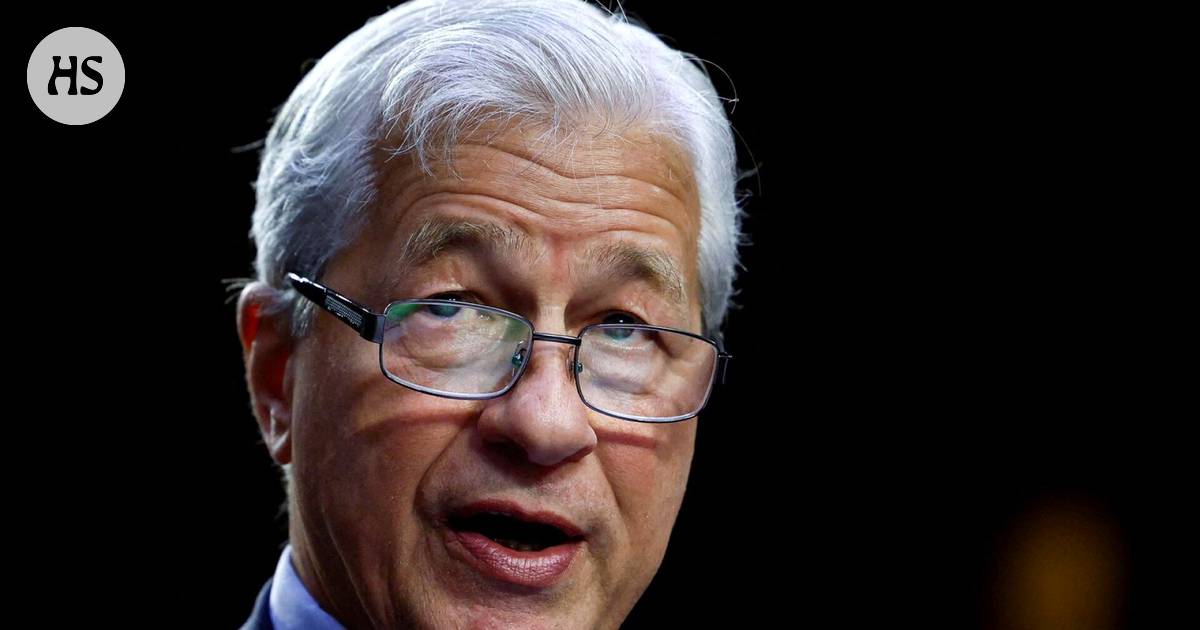

The stock market can see an even more painful decline, and the whole world is sinking into recession, says Jamie Dimon, CEO of JP Morgan.

American CEO of the giant bank JP Morgan Jamie Dimon estimates that the United States and the world economy may drift into recession by the middle of next year.

According to Dimon, there are now several alarm bells pointing to a recession, such as rampant inflation, a steeper-than-expected rise in interest rates, the unexpected effects of monetary policy tightening, and Russia’s war of aggression in Ukraine.

“These are very, very serious issues that I think will probably push the United States and the world — Europe is already in recession — into some sort of recession in 6 to 9 months,” Dimon told the US for the CNBC channel.

Read more: Fear gripped the stock market, and it is a sign of the danger that threatens the economy of the United States and the Eurozone

In the stock market it’s been a wild ride this year. The most followed stock index S&P 500 has fallen by a good 23 percent this year, the technology-focused Nasdaq by almost 33 percent and the Dow Jones by almost 20 percent.

According to Dimon, the S&P 500 could sink “easily another 20 percent” from its current level. He states that the future slide would probably be “much more painful than the first”.

JP Morgan, the world’s largest bank by market value, will announce its third quarter results on Friday.

Dimon is not alone in his view of recession.

President of the World Bank David Malpass and Managing Director of the International Monetary Fund (IMF). Kristalina Georgieva warned on Monday that the risk of recession in the global economy is increasing. The institutions organized the first face-to-face meeting since the beginning of the pandemic.

“There is a real risk and danger that the world economy will drift into recession next year,” Malpass said, according to the Reuters news agency.

According to Georgieva, economic growth is slowing down in the three most important economies. Europe has been hit by high natural gas prices, China’s housing market is declining and pandemic restrictions are slowing down growth, while in the United States interest rate hikes are “starting to bite” economic growth as well.

JP Morgan’s Dimon already warned of a coming “hurricane” in the economy in the summer. At the end of July, the IMF also warned about the gloomy economic outlook for the US and the euro area.

During the fall, your mood has weakened even more.

To recession there is no single simple definition.

In the United States, the National Bureau of Economic Research estimates when the economy is in recession. When defining a recession, it takes into account, in addition to gross domestic product, how real household income, employment, real household consumption, wholesale and retail trade, and industrial production have developed.

Read more: Caution is a trump card, but when should you return to the stock market?

Read more: The European Central Bank continues to raise interest rates to curb inflation

Read more: Germany had to save Uniper, says the country’s finance minister – the country now has one threat above all others

Read more: The economy of the euro area is slipping into the bottom: “The probability of a recession is very high”

#Banks #giant #bank #Morgan #warns #recession #painful #stock #market #crash #ahead

/s3/static.nrc.nl/wp-content/uploads/2022/10/web-1110binomgeving.jpg)