01/02/2024 – 18:58

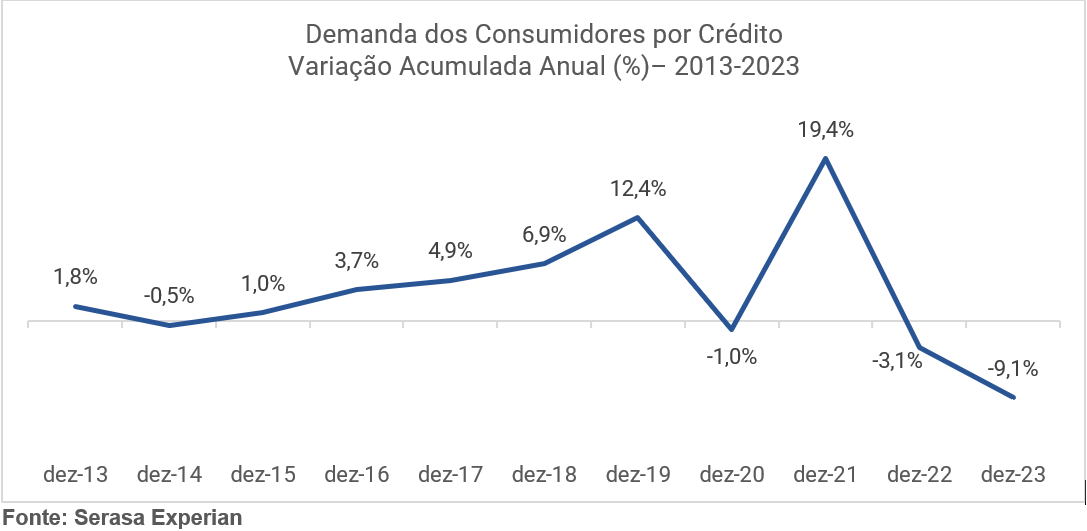

Serasa Experian's Credit Consumer Demand Indicator showed that, in 2023, consumer search for credit and financial resources fell by 9.1% in Brazil, compared to the previous year.

According to Serasa, this is the lowest percentage ever recorded since the beginning of the historical series. See the annual comparison below:

“After 2022, this is the second consecutive year of contraction. The “culprits” for keeping Brazilians away from the credit market in 2023 were unattractive rates, impacted by the rise in the Selic rate, in addition to high default rates,” comments Serasa Experian economist, Luiz Rabi.

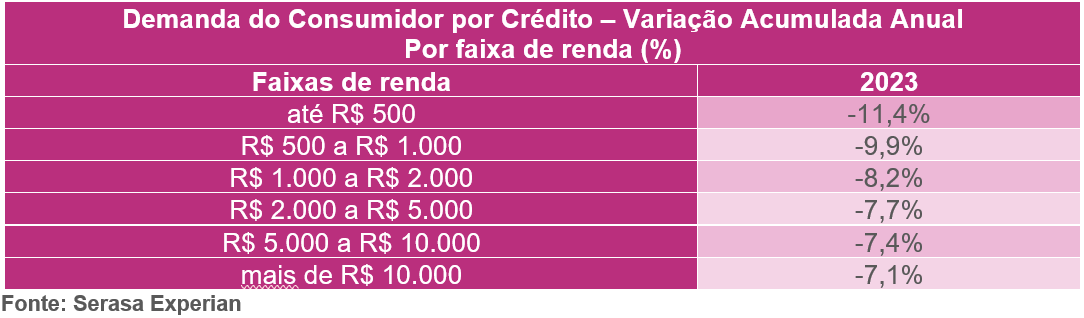

In the analysis by monthly personal income of the indicator, it was Brazilians who earn up to R$500 who showed the most significant drop (-11.4%) and those who earn more than R$10 thousand per month, the smallest (7.1 %). Check out the complete data below:

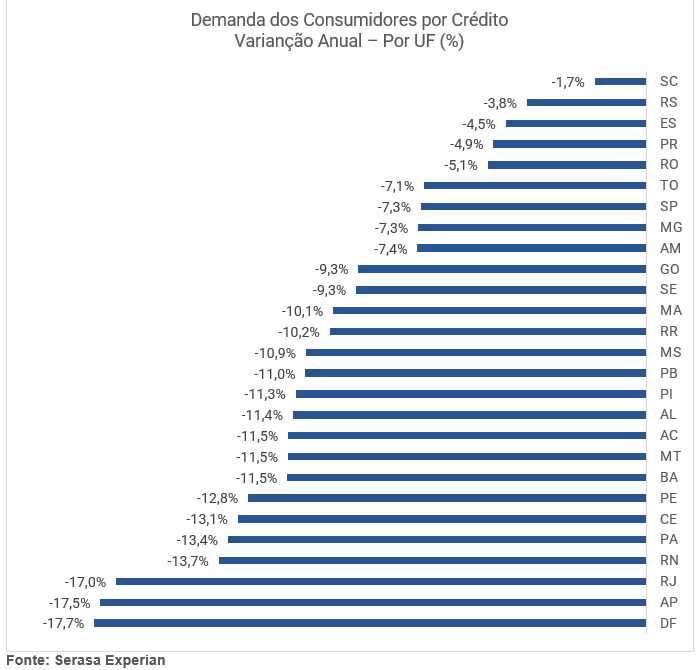

Credit demand by state in 2023

Still according to the indicator, all regions recorded a drop in the search for financial resources in 2023, with emphasis on the Federal District (17.7%), Amapá (-17.5%) and Rio de Janeiro (-17 .0%). Only Santa Catarina was below 3% retraction. See the data for all Federative Units (UFs) below:

#Consumer #search #credit #drops #points #Serasa