On April 2, the period to make the income statement corresponding to the exercise of 2024 begins. This period will be extended until June 30 and, as usual, it can be carried out online, by telephone or face -to -face.

Although there are still a few weeks left to officially access the draft, the Tax Agency has already activated the simulator that allows taxpayers anticipate what the result of your statements will be. In addition, it is a few weeks in which those who must present it take the opportunity to get their calculations and have everything clear as soon as the campaign is officially opened.

The main difference between the draft and the simulator of the income statement is that the second does not allow the declaration or need to identify or have all the fiscal data.

How to access the Simulator of the Income Declaration

To access the simulator you have to access ‘Open web rent’. With doing a search is one of the first options directed to the Tax Agency website called ‘Simulators’ and that was updated on February 1. The taxpayer has several models to simulate such as companies, of model 303, IVAN or model 390.

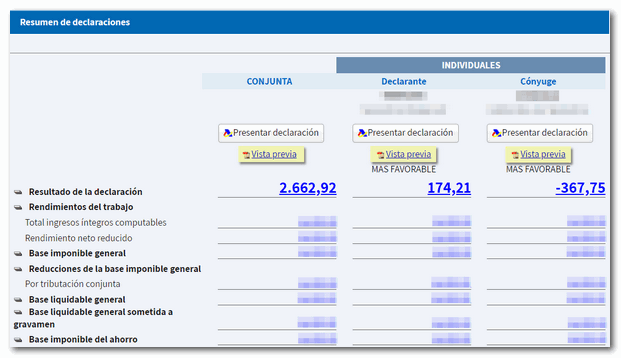

When accessing, the application allows a statement introducing the appropriate data or loading a statement previously saved and created with the same application. Once all the data is entered, it is passed to the results screen where the hypothetical result of the next statement appears. It is also possible to download the simulation.

-

1. Access Open web rental rental

-

2. Select ‘new statement’ or ‘load’ to use previous statements as a base

-

3. Complete the requested data

-

4. Insert the data in the corresponding boxes

-

5. Perform the simulation that, in an unofficial way, will say if the result will be to pay or return

The result offered by the Tax Agency Simulator

Tax Agency

Who can access the simulator

If an identification is not necessary, anyone who has to submit the income statement can use the simulator since their use is free and free. At this point, it should be remembered that in this 2025 the results corresponding to the exercise of 2024 are presented.

Also, employees with a Only payer who charge less than 22,000 euros are not obliged to submit the statement. This same limit also applies when the work yields come from more than one payer, if the sum of the perceived amounts of the second and remaining payers, by order of amount, do not exceed as a whole the amount of 1,500 euros per year.

In the event that the employee has more than one payer the limit is at 15,876 euros.

#Simulator #Income #Declaration #result #pay #return