Older adults who are most vulnerable to financial scams may have brain changes linked to a higher risk of contracting the disease, according to a first-of-its-kind study by researchers at the USC Dornsife College of Letters, Arts and Sciences. Alzheimer’s disease.

Financial Scams and Alzheimer’s Disease

Nearly 7 million Americans live with Alzheimer’s disease, the fifth leading cause of death among people over 65. The disease will cost an estimated $360 billion in health care costs this year alone, according to the Alzheimer’s Association.

Researchers led by Duke Han, a professor of psychology and family medicine at USC Dornsife, wanted to better understand the link between early-onset Alzheimer’s and financial vulnerability, using high-powered MRI to scan the brains of 97 study participants over the age of 50.

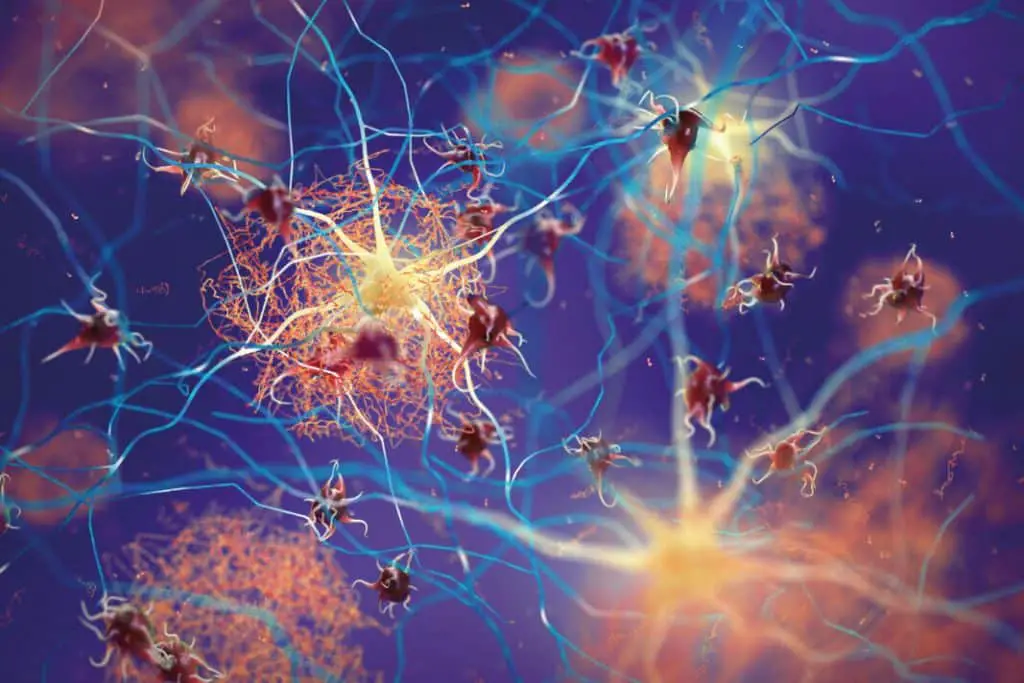

The scientists focused on the entorhinal cortex, a region that acts as a relay station between the hippocampus, the brain’s learning and memory center, and the medial prefrontal cortex, which regulates emotion, motivation, and other cognitive functions. It is often the first region to show changes in Alzheimer’s, typically thinning as the disease progresses.

None of the study participants, aged 52 to 83, showed clinical signs of cognitive impairment, but all underwent MRI scans to measure the thickness of the entorhinal cortex.

Additionally, the researchers used a standardized instrument called the Perceived Financial Exploitation Vulnerability Scale (PFVS) to assess participants’ financial awareness and their susceptibility to bad financial decisions, which they call “financial exploitation vulnerability,” or FEV.

By comparing the FEV of adults with the thickness of their entorhinal cortex, Han and his team discovered a significant correlation: those most vulnerable to financial scams had thinner entorhinal cortexes.

This was especially true for participants aged 70 and older. Previous research has linked FEV to mild cognitive impairment, dementia, and some molecular changes in the brain associated with Alzheimer’s disease.

Han, who holds a joint appointment at the Keck School of Medicine of USC, says the findings provide crucial evidence to support the idea that FEV could be a new clinical tool for detecting cognitive changes in older adults, changes that are often difficult to detect.

“Assessing financial vulnerability in older adults could help identify those in the early stages of mild cognitive impairment or dementia, including Alzheimer’s disease,” Han said. He added, however, that financial vulnerability alone is not a definitive indicator of Alzheimer’s disease or other cognitive decline. “But assessing FEV could become part of a broader risk profile,” he said.

Han also noted several limitations of the study. Most of the participants were older, white, highly educated women, making it difficult to generalize the findings to a more diverse population. Additionally, while the study found a link between entorhinal cortex thickness and FEV, it did not prove it. Finally, the study did not include specific measures of Alzheimer’s disease pathology.

These limitations leave open the possibility that the relationship between FEV and thinning of the entorhinal cortex could be explained by other factors. As a result, Han said that more research, including long-term studies with diverse populations, is needed before FEV can be considered a reliable cognitive assessment tool.

The work was published in the journal Cerebral Cortex .

In addition to Han, the study’s authors include Laura Fenton, Aaron Lim, Jenna Axelrod, and Daisy Noriega-Makarskyy of USC Dornsife; Lauren Salminen, Hussein Yassine, and Laura Mosqueda of the Keck School of Medicine of USC; Gali Weissberger of Bar-Ilan University in Israel; and Annie Nguyen of the University of California, San Diego.

#Falling #Financial #Scams #Sign #Early #Alzheimers