Pensions far away and at half the salary: for “young” workers the possibility of early retirement three years before the old age requirement is no longer possible

It's a pension alarm (again). Not only because the age at which one can go there is getting further and further away, but also because the amount of them has been drastically reduced over the years. This is what emerges from the latest survey carried out by Moneyfarman independent financial consultancy company with a digital approach, which paints the picture of a real emergency.

In 2024 in Italy the pension expenditure/GDP ratio[1] – one of the indices with which the sustainability of public welfare is measured – will rise to 16.2% from 15.8% in 2023: an increase also due to the revaluation of pensions due to inflation and which will significantly impact the future of the pension system and citizens. Please remember that, in 2010, an expenditure/GDP ratio of 15% was forecast for 2020 and around 16% for 2045: just one percentage point is equivalent to approximately €19 billion per year in pension spending.

The situation is so delicate that the 2024 Reform, for the first time since the Monti-Fornero Reform of 2011, has changed the rules not only for those close to retirement age (Quota 103 and Women's Option), but also for those who have started working in 1996 and are included in the contributory calculation system. For these “young” workers, the possibility of early retirement three years before the old age requirement is eliminated (now equal to 67 years): the value of the pension must in fact be equal to at least 1,320 euros net per month (3 times the social allowance, previously it was 2.8); this threshold drops slightly for female workers with one child (2.8 times) and with two or more children (2.6 times). Furthermore, in the early years (up to the age of 67), the pension cannot be higher than approximately 2,230 euros net per month (38,910 euros gross per year, equal to 5 times the minimum payment). Good news only for those with low pensions: in fact, the group of those who risk retiring at 71 years of age and beyond with the contributory old-age pension is narrowing (previously the minimum pension threshold was 672 euros net per month, while today it is dropped to 534).

According to the OECD[2], those entering the world of work today will spend around a third of their future lives in retirement but, starting around 2030, the situation for public finances runs the risk of becoming further complicated as many Boomers enter retirement. Supplementary pension provision is still not widespread: to date only 26 Italians out of 100[3] they are actively putting aside answersweapons in complementary pension instruments and in the period 2007-2022 only 22% of TFR was allocated to this type of instrument. Among other things, at the end of 2022, there were almost 2.5 million “silent” people, i.e. people who own a pension fund but who have stopped paying, of which about half have been there for over 5 years.

Pensions, case study: comparison between four generations of Italians today (aged 30, 40, 50 and 60)

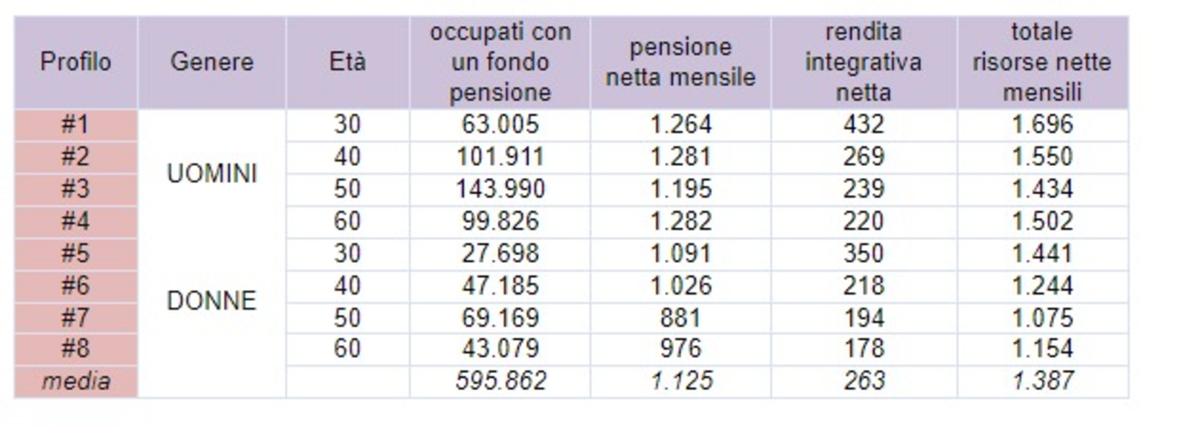

Moneyfarm, in collaboration with Smileconomy, has elaborated an ad hoc case study[4] on 8 profiles of Italian men and womenequal to 3,182,376 inhabitants (just over 5% of the population) who will turn 30, 40, 50 and 60 years old in 2024 (i.e. those born in 1994, 1984, 1974, 1964) and who will retire between 2031 and 2062 (M30, M40, M50, M60, F30, F40, F50, F60).

As for the public pension:

- for that 53% of employed people in these age groups, representing 1,694,007 workers, theretirement age it ranges from 65 years and 6 months for those in their fifties up to 68 years for those in their thirties;

- the estimate of values of average net pensions it fluctuates between €881 for women in their fifties and €1,282 for men in their sixties, with an overall average for the 8 profiles of €1,125 net per month;

- percentage replacement rates falls sharply for the new generations, going from 66% of those who are 60 years old today to 46% for women who will turn 30 in 2024. Unfortunately, the data show how the objective of being able to count on 80% of one's salary at retirement is a thing of the past;

- for the value of the pension, the average curve of evolution of income over time of employees in the private sector was considered. There scissors between men and women it is significant, in the order of 17%-18% for women in their thirties and forties and 21%-22% for women in their fifties and sixties, with an average of 19.7%;

-

the effect of salary range is expressed on the value of the pensionespecially as age increases, with differences between 14% and 26%, with an average pension of €1,256 for men and €994 for women, equivalent to a range of 26%;

-

the estimates are even optimistic compared to labor market scenarios, because they assume work continuity from the age of 25 until retirement. Furthermore, they assume the permanence of current legislation, an element that cannot be taken for granted given the long time horizon and the pressures on the social security system;

-

the simulations use the income trend of employees; it is reasonable to estimate that for i self-employed the values of the public pension may be lower, as they are based on lower average taxable incomes and a lower contribution rate, as well as on more discontinuous careers;

-

the estimates do not concern the inactive or i unemployedwho can conceivably expect an even lower paycheck.

As for the supplementary pension:

Adding pension public and complementary:

- of the 3,182,376 citizens (also including the inactive and unemployed) born in the years surveyed, only 19% have a pension fund and could guarantee a total of €1,387 net per month;

- 35% of the sample does not have a pension fund and could therefore only rely on the public pension, of €1,125 net per month;

- 7% of unemployed people may have a pension fund, but have probably stopped paying in;

- the remaining 39% will only be able to support themselves with pensions already being paid or other forms of assistance.

Pensions, the identikit of those who pay into supplementary pensions[5]

He signs up late, pays little, with low risk and in the end prefers to collect the entire capital: Here is the identikit of the average supplementary pension member. The average member is male (62%), is 47 years old, pays €177 per month, has so far set aside €22,180 and prefers to redeem the entire capital at the end. If we differentiate by gender and age, men pay more per month (€195) than women (€158). The average contribution increases as age and therefore economic resources increase. Only approximately 7.8% of members manage to pay the maximum deductibility granted by the preferential tax treatment (€5,164/year). At a national level, at the end of 2019, €206 billion had been set aside in supplementary pensions (€22,180 average per member); for almost one position in four, however, the accumulated capital does not exceed €1,000 in total.

Andrea Rocchetti, Global Head of Investment Advisory at Moneyfarmcommented: “The data that emerge shows how necessary and urgent it is to immediately take care of one's future, integrating the public pension with some form of supplementary pension. The managed savings industry is called to take action to stimulate awareness of the inadequacy of public pensions alone and to accompany workers and non-workers in choosing the form of supplementary pension best suited to their needs, helping them to better understand the characteristics of the products available on the market. market, their benefits and to overcome the inertia that often prevents us from thinking concretely about our future well-being. In countries where supplementary pension provision is more widespread, the citizen is on average more familiar with the concept of financial planning and is able to recognize the value of professional advice”.

#Pensions #salary #millions #workers #alarm