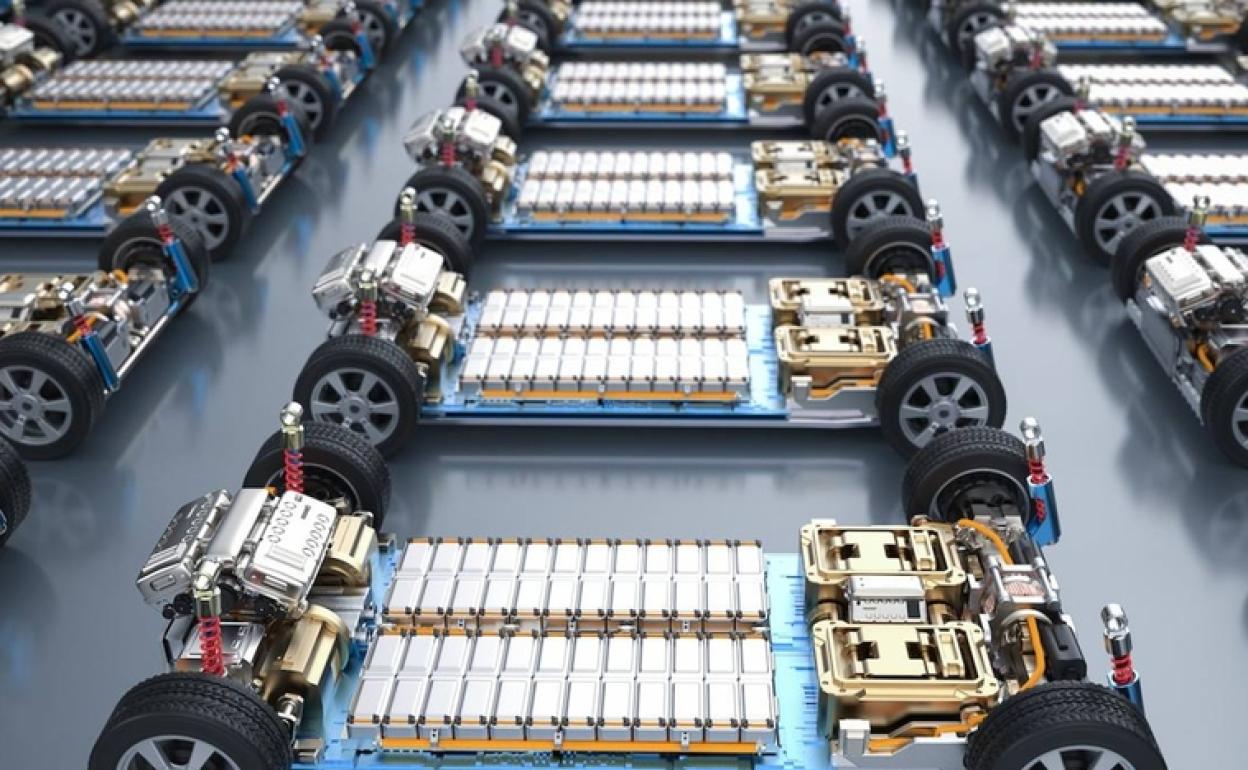

More than three quarters of the planned production of lithium-ion batteries in Spain is at risk of being delayed, reduced or cancelled, according to reports from the environmental organization T&E. According to his information, 79% of the projects to produce lithium-ion batteries for electric vehicles in Spain could be jeopardized due to US protectionism, through the Inflation Reduction Act (IRA), which pays 369,000 million green industrial initiatives , including factories of this type.

“IRA Act subsidies are the main threat to gigafactory plans, unless Europe offers accessible incentives and expedites permits,” the organization warned in a statement.

According to T&E’s analysis, this threat has included the plants of the Asian Envision in Navalmoral de la Mata (Cáceres) and Basquevolt in Vitoria, initiatives “that have not yet secured sufficient financing”, the entity highlighted.

Envision was left out of the first line of aid from the Strategic Project for the Recovery and Economic Transformation of the Electric and Connected Vehicle (Perte VEC) due to its lack of roots in Spain, however, it expressed its intention to continue with the project.

He also indicated his intention to apply for the second call for aid from Perte VEC, in which certain aspects will be made more flexible, such as the one that led to the exclusion of the company’s project in the first round. In addition, it has already requested 115 million euros from the regional incentives granted by the State to “promote business activity” and direct its location towards previously determined areas to alleviate inter-territorial imbalances.

Meanwhile, the Basquevolt project is expected to start producing battery cells in 2027 with the goal of reaching 10 gigawatt hours of capacity. This industrial initiative will require an investment of 700 million euros and will generate around 800 direct jobs.

In this context, T&E requests both “support at the European level with financial aid to scale up battery production and faster approval processes” to capture projects that “are at risk of receiving US subsidies.”

“The report considers that there is a medium risk for Envision, which has not yet been awarded funding from the Perte VEC. Basquevolt, whose funding is mainly geared towards research projects and appears insufficient for the scale of production required for the project, is also medium risk,” the organization noted.

On the other hand, T&E has highlighted that the possibility that the Slovak Inobat project, which is currently evaluating whether to locate its new battery gigafactory in Valladolid or in a city in the United Kingdom, runs an “even greater risk” of not finally land in Spain.

Threat in Europe

According to the report, throughout Europe, 68% of the planned manufacturing projects for lithium-ion batteries are at risk and, specifically, a battery production capacity equivalent to 18 million electric cars (1.2 terawatt hours). “is at high or medium risk” of being interrupted or lost.

“Without this expansion, Europe will not be able to meet its demand for batteries in 2030 and will have to import them from foreign competition,” said T&E, which has evaluated the 50 gigafactories announced in the Old Continent based on their financing and permits, if they had secured a location and the companies’ ties to the United States.

“Battery manufacturing in the EU is in a tremendously delicate situation between the US and China. Europe must act or risk losing everything. A green industrial policy focused on batteries, with support throughout the EU to increase their production, is urgently needed in order to react to US subsidies and years of Chinese dominance,” said the head of Car Electrification at T&E, Carlos Rico.

The cheapest electric cars

Along these lines, the organization has pointed out that Germany, Hungary, Spain, Italy and the United Kingdom are the countries that “stand to lose the most if battery manufacturers change their plans.”

According to his analysis, Tesla’s ‘Giga Berlin’ plant is the one most at risk of delays in Europe after it announced it would focus battery cell manufacturing in the United States to take advantage of IRA Act incentives.

“There is medium risk for Northvolt’s planned gigafactory in Heide, Germany, as the company has only secured part of the financing and has not started construction. In addition, Northvolt’s CEO said last October that he could delay the plant and prioritize expansion in the United States,” added T&E.

In this way, Rico has opined that Europe’s response to the IRA Law, which is expected to be known on March 14, should “replicate” its simplicity and visibility through a central fund accessible to all Member States to Prioritize the value chains of batteries, renewable energy and smart grids.

“The EU cannot compete unless it has a strong industrial policy that focuses on increasing production and rewards environmentally sustainable projects,” he added.

#United #States #threatens #future #battery #plants #planned #Spain #truth