The foldable smartphone market is increasingly growing: panel shipments for these devices increased 46% year over year in the first quarter of 2024, reaching 3.94 million. This is what emerges from the latest DSCC report, which also provided us with details on the health status of individual producers.

And if BOE and Huawei currently maintain the first position respectively for the production of panels and sales of foldable smartphones, it is likely that in the short term Samsung Display and Samsung will be able to oust them from their leadership. We specify that in this case Samsung Display and Samsung are considered as distinct companies, one producer of panels, one of smartphones. But together let’s go into the details of the data.

Samsung against BOE and Huawei: a three-way fight

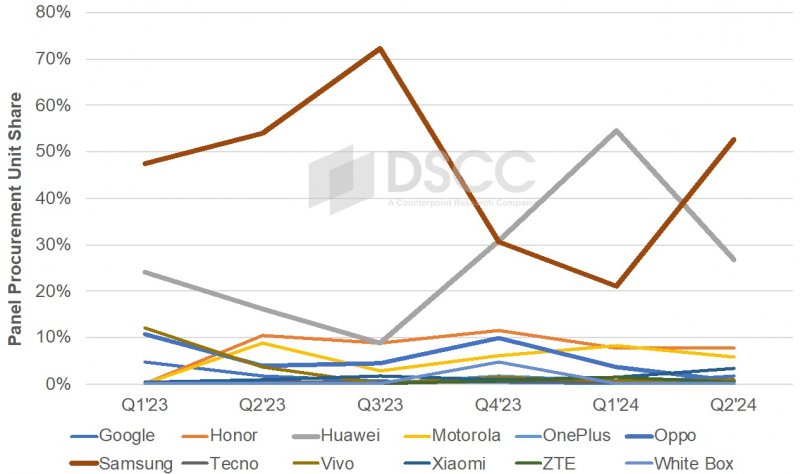

In the first quarter of 2024 Huawei dominated purchases of panels for foldable smartphones with a share of 55%, the highest ever. Notably, the Huawei Mate on Samsung in the fourth quarter of 2023. In the first quarter of 2024, panels for 24 different foldable smartphone models were purchased.

While the first quarter of 2024 was a seasonally slow quarter for the foldable market, the second quarter of 2024 is expected to set a new record for foldable smartphone panel purchases, reaching 9.25 million. Sales will be led by Samsung Display, which has already started panel shipments for its latest Z Flip and Z Fold models a month earlier than last year, in April instead of May. Huawei’s panel purchases are also expected to continue to grow.

In the second quarter of 2024, however, Samsung is expected to maintain a 52% advantage versus 27% over Huawei in panel purchases, with the upcoming Z Flip 6 and Z Fold 6 being the two models with the highest volume in terms of purchases of panels. Huawei will have models number 3, 4 and 6 in terms of panel purchases. The report also predicts that panels for 27 different models will be purchased in the second quarter of 2024. In terms of actual sales, Huawei will still lead in the second quarter of 2024.

Throughout 2024, Samsung’s share of thesupply of panels for foldable smartphones drops from 54% to 48%, with over 13 million panels, followed by Huawei with a 28% share, up from 18%, and Honor with a 10% share, up from 9% . There is expected to be a supply of panels for 38 different models in 2024, up from 35 in 2023. Samsung is expected to have three models in the top 10, while Huawei will have four and Honor two.

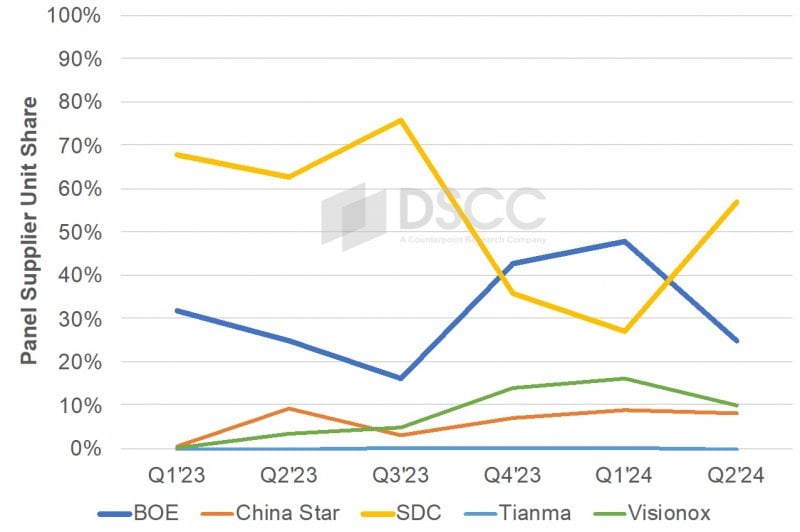

In terms of share of panel suppliersWhile BOE outperformed Samsung Display (SDC) in Q4 2023 and Q1 2024, SDC is expected to maintain a 57% versus 25% lead over BOE in Q2 2024 and an even larger lead in Q3 2024. quarter of 2024 as production of the Z Flip 6 and Z Fold 6 increases. Throughout 2024, SDC is expected to surpass BOE with a 54% share versus 28%. SDC’s share will be down from 62% in 2023, while BOE’s share will increase from 27% in 2023. Visionox is ultimately expected to gain the most share in 2024 reaching 11%, with China Star increasing to 7 %.

#Samsung #return #leading #manufacturer #folding #panels #records