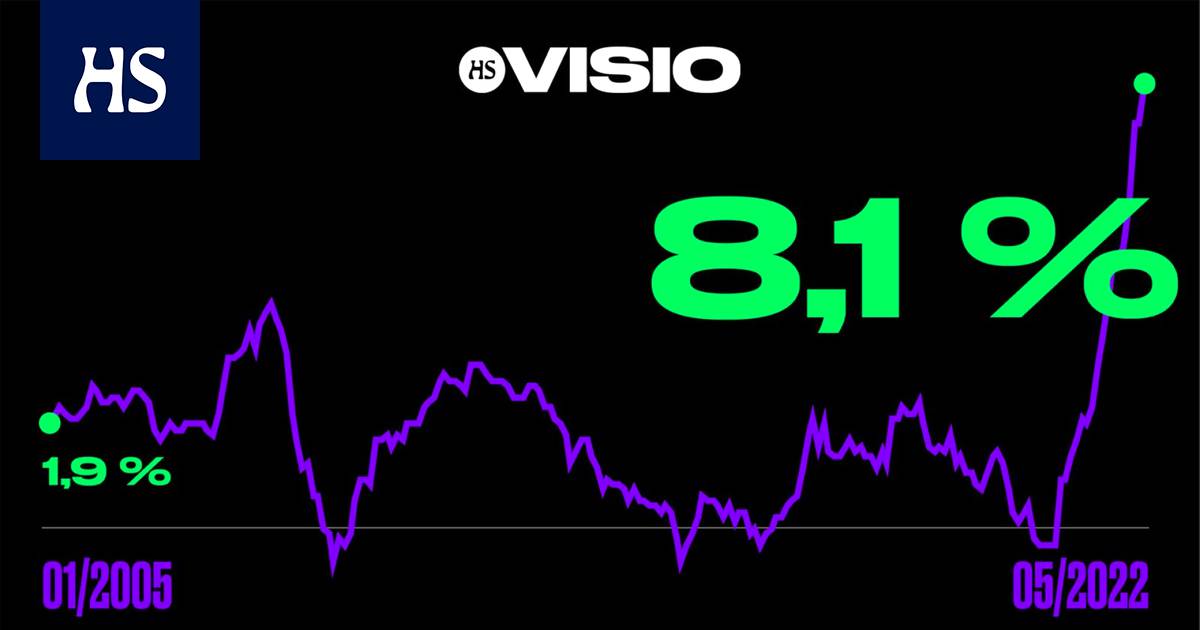

The graphics in the HS Vision article show how inflation got out of hand.

Inflation came anyway.

It was long overdue. Central banks have been blaming the market for money since the 2008 financial crisis.

The European Central Bank has kept interest rates close to zero since 2014 and has also supported indebtedness by buying government and corporate bonds.

Inflation has been considered a threat from the beginning, but remained low from year to year.

Hunger grows when eating. While the continued recovery in the early 2010s did not lead to an acceleration in inflation, central banks continued to do so. The loan money became permanently cheap.

The inflated debt burdens did not lead to new problems, and the temptation of governments to loose fiscal policies increased.

Then came the pandemic. Central banks and governments had a playbook ready to deal with the looming economic crisis: More money. More resuscitation. Increase debt.

At first, everything went well, but then inflation woke up like a bottle. And it’s not easy to push it back.

The graphics below tell the story of how inflation got out of hand.

In June In 2022, inflation in the euro area was at an all-time high. The rapid rise in interest rates raised concerns, most notably fears about Italy’s debt sustainability.

The European Central Bank held an emergency meeting to calm the market. It promised to develop new instruments to help heavily indebted eurozone countries.

More and more economic experts began to dictate that the economy was plunging into recession in both the United States and Europe. The beginning of the year has been the weakest in the stock market for more than 50 years.

#Inflation #Inflation #woke #nonrecoverable #bottle #spirit #Vision #graphics #show #step #step #prices #hand